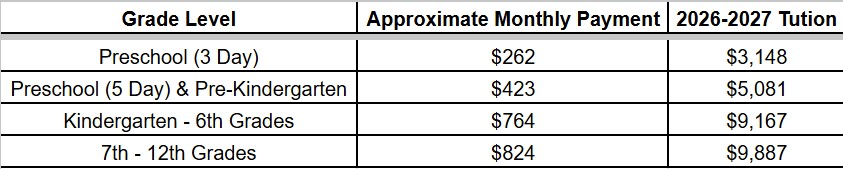

2026-2027 Tuition and General Fees

As a parent, you know that your children are your biggest investment. You want what is best for them in all aspects of their lives, and you do your best to provide that. Perhaps this is why you are considering Christian education. You want them to be well-educated, cared for, and safe from threats of this world. But what about the cost? It is a priority of Grace Christian School to carefully manage finances in a manner that will keep the Christian school option affordable for our families.

The financial contributions of many help make this possible, from staff who are willing to serve for lower compensation than they might receive in the public workplace to our long-term relationships with donors who have partnered with us over the years. As part of our covenant community emphasis, and in addition to paying tuition, each GCS family participates in our annual "Pass It On Project" and "GCS Benefit Auction" through monetary gifts, goods, or service donations according to each family’s ability (2 Corinthians 8:3). The commitment of so many enables the school to maintain a lower tuition rate than many schools with comparable programs.

The Value of a GCS Education

- Christ-Centered: Biblical worldview is a part of everything that we do in the classroom, as teachers guide our students to see God’s hand in every part of life.

- Community: The relationships that are formed here between students and teachers, parents and staff, and students and their peers work together to strengthen your family as you seek to raise your children to know the Lord.

- Holistic: We want to partner with parents to develop the whole child. We aim to prepare them to excel in whatever profession they choose, as well as giving them life skills, from serving in the community, mentoring, internships, extracurriculars, and much more.

- Security: Your children’s well-being is a priority for you as a parent, and we take that seriously. Along with controlled access into all of our facilities, and cameras in and outside of our buildings, our employees are trained and our students drilled to prepare for an assortment of emergencies.

- Supportive: Our teachers desire to love and educate children academically and spiritually. Our classroom size is small to allow for individualization, and all our teachers are well-trained and receive monthly professional development to better serve students and families.